You couldn’t pick a better state to start a cleaning business. Florida’s combination of high growth (15% in the last decade), combined with a business-friendly environment, means you’ll face fewer barriers to success than in other markets. I hope that’s music to your ears.

As you can see, you’re well-placed to start a cleaning business in Florida. Let’s get into the nuts and bolts of how to name your business, get key licenses, structure your business, get insured, get equipped, and get clients!

Why Florida is a great place to start a house cleaning business

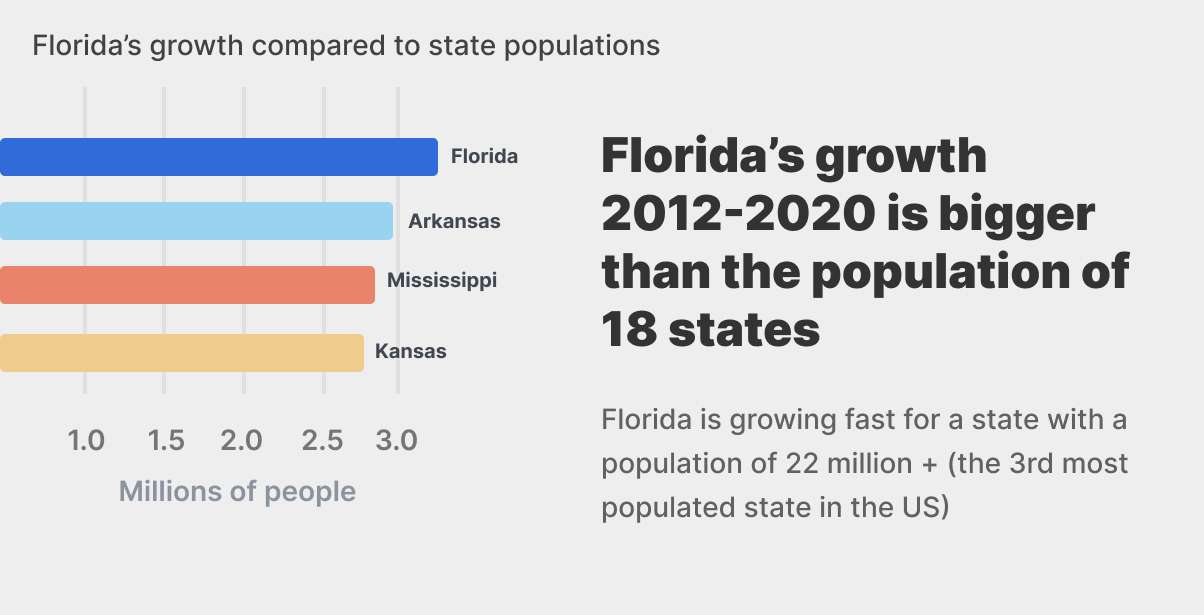

Florida is a great place to think about starting a residential cleaning business. Not only is the state growing like gangbusters, but the state is business-friendly, with no income or sales tax. Indeed, Florida’s population growth over the last 10 years has been a little over 3 million people. For comparison, that 3 million is bigger than the population of 18 states.

With 22 million people, Florida is the 3rd most-populated state. You’ve got lots of potential customers with a market that large. And, with 1,000+ people moving to Florida each day, your business has room for growth.

Figure out if house cleaning is for you

Skip if you’re solid on your plan. But, if you haven’t cleaned houses before, you want to make sure you understand what you’re getting in for. House cleaning is a physically demanding business. Practice on your own house. Not just whether you can maintain the stamina it takes to clean a house from start to finish with no breaks, but also how you go about cleaning the house to make sure you’re efficient, and able to get everything. Systematically cleaned homes will have happier customers.

A quick overview of starting your residential house cleaning business in the state of Florida

While commercial cleaning has many similarities to residential cleaning, we don’t cover the specifics of commercial cleaning in this article. With that disclaimer, let’s get started. Here’s the TL;DR:

- Name your business – it’s more professional if you don’t include your name. Need help? We’ve got a comprehensive guide to naming your cleaning business

- Register a fictitious name with the State of Florida Division of Corporations

- See if your city requires a business license to operate – many require this

- Define your ideal customer – who are they, and what neighborhoods do they live in?

- Use door hangers to find clients. If 1 in 50 converts, you’re doing great

- Start cleaning! And don’t stop

Name, license and register your business in the state of Florida

The approach outlined in this step will create a sole proprietorship. This is a no-frills business. Consider it the minimum for operating legally in the state of Florida.

We’re talking about this first because it’s the cheapest, fastest, and least complex way to start a business.

It does, however, have its downsides, which we’ll discuss later. With that said, let’s move on to naming your business.

Name your cleaning business

Unless you want to do business under [your name] cleaning/maids (which we don’t recommend), you need to pick a solid name for your business. If you want help, we’ve got a guide recommending different naming approaches. People want clean homes (shine, sparkle, clean) and want to feel relaxed (easy, zen, relax). Think about how you want your clients to feel when they walk into their home, which you’ve immaculately cleaned.

Register your cleaning business with the state of Florida

We’re not attorneys, so we can’t recommend an approach to structuring your business. However, many cleaning companies start with a simple fictitious name registered by the State of Florida Division of Corporations.

You won’t have the protection offered by an LLC, however fictitious names are a cheap way to get started. Indeed, the state of Florida charges $30.00 for a certified copy of the Fictitious Registration Name – it proves that your business is indeed registered with the state of Florida. It’s $10.00 if you want a certificate of status. From the state of Florida site:

A certificate of status certifies the registration has been filed and is active with the Division of Corporations

With this approach, you’ll pay taxes on your income from the business (please report your full income, no one wants to be audited) via your social security number.

Get a local Business License

As of the writing of this article, the state of Florida didn’t appear to require a special permit to start a residential cleaning business. While many trades require state licensing, residential cleaning does not appear to. Please check this point with an attorney or do your research on the OpenMyFloridaBusiness, the state’s licensing and permitting site.

Operating a business in Florida cities is a different matter, however. Many cities in Florida require a business license to run a cleaning business in their jurisdiction.

For example, the city of Miami requires a certificate of use, as well as a business tax receipt to do business in Miami. Many cities in Florida may have similar documents required to do business in the city. If you’re interested, you can learn more about starting a business in Miami on the official city Miami website.

How to define your target market and book your first clients

Who will your customers be? Where do they live? And how will you price your services so they are profitable? While these questions are beyond the scope of this article, it’s important to target the right market. Some people don’t want to think about having a clean house, and will pay for the convenience if you can deliver on the promise of high-quality cleaning and excellent customer service.

Create some door hangers and pass them out

You’ll need to figure out where your target market lives – so you can drop a door hanger on their front door. Many successful cleaning businesses swear by door hangers. They are much cheaper than starting a website, and probably much more effective in the short term.

If you need help with effective and customizable door hangers, we sell them. So do many print-on-demand companies. Find some and order a few to test out on your target market. Drop 50-100 off and see what kind of results you get.

We’ve also written a more detailed post on how to find your first customers for your cleaning service.

Start booking cleanings!

Be ready to answer that phone! The person who calls is a hot lead. Taking too much time to respond will decrease the chances – exponentially – that they book with you. Answer the phone, quote the home based on square footage and rooms, and get to work. You might offer discounts for the first few clients, but you’ll want to have a clear picture of how much you need to make per home based on the time it takes to do the cleaning.

Wait! Do I need a house cleaning license in Florida?

There’s no special permit needed to be a residential cleaner in Florida – that I could find in extensive research with the Florida state government. Please do your own research to make sure you’re compliant. You will need the naming, business entity structure, and local permit and taxation records – but there’s no single ‘license’ or special permit for residential house cleaners at the state level in Florida.

Congrats – you’ve started a cleaning business in Florida! Now it’s time to level up

Once you’ve proven the business model, it’s time to consider the structure of your business

Remember how I mentioned that starting as a sole proprietor would leave you and your wealth vulnerable to lawsuits? Well, it’s true. As a sole proprietor, there’s no separation between you and the business. I’ve written a whole article about the kinds of organizational structure the state of Florida offers its business owners. There’s a variety and it’s beyond our scope to explore them all here. What I can say is that an LLC (limited liability company) will create distance between you and the business. That creates a kind of shield for your personal assets. And believe me, if you’re successful in business, you will start to accumulate cash, as well as assets like real estate.

What are the pros and cons of an LLC in Florida?

Pros

- The LLC creates a protective separation between you and the business

- Protects your personal assets (for example, from a lawsuit)

- The business can create bank accounts, get loans, etc.

- Tax benefits – pass-through taxation avoids the double taxation imposed on corporate earnings.

- No corporate minutes or resolutions

- No limit to the number of members

Cons

- It’s more paperwork

- You’ll still need a fictitious name, since LLCs need to have ‘LLC’ in their name and you may want to do business under another name

- It’s more expensive than setting up a sole proprietorship

- You’ll need to register for an EIN (employment identification number) from the IRS

- Taxes for an LLC may be more complex come tax season

- You’ll need to set up separate bank accounts – creating administrative complexity

Florida taxes for a house cleaning business

As a sole proprietor

Filing taxes is ‘straightforward’ (as can be when we’re talking taxes) as a sole proprietor – at the federal level, you’ll use your social security number and record your income from your cleaning business. Cities are all different; you’ll have to figure out how your city and county has structured your taxes to make sure you’re paying your dues.

As an LLC or other type of business entity

You’ll register an EIN for the business in most cases, which will identify the business to the IRS. The business will pay taxes on the income from your cleaning business to the IRS, and to any city or county government per local law. You’ll also continue to file personal taxes.

In addition, if you’d like more details about applying for an EIN, check out our detailed article on the topic.

Special use tax

I found a document from the state of Florida that spells out what kinds of cleaning services need to be collecting sales tax. From the document:

Charges for cleaning residential facilities are not taxable

Airbnb properties are taxed on cleaning fees if they are mandatory. I’m not a lawyer, but reading the document, it sounds like the owner of the Airbnb is responsible for recovering the sales tax. Please consult a tax attorney if you are cleaning these kinds of residences.

From the above document:

Example: Rosie rents her beach house to the Smith family for three months. Rosie requires all tenants to pay a mandatory cleaning fee. Rosie hires ABC Cleaning Services to clean the beach house. Although Rosie’s rental to the Smith family is taxable, the cleaning charge to Rosie for cleaning the beach house is not taxable because the charge to Rosie is for cleaning a residential facility. However, the mandatory cleaning fee Rosie charges the Smith family is part of the rental charge, which is taxable.

Does Florida require you to insure your house cleaning company?

Insurance and Bonds

It is crucial to have adequate insurance coverage for your cleaning business in Florida. This includes general liability insurance to protect against accidents, property damage, and potential lawsuits. Additionally, consider workers’ compensation insurance if you plan to hire employees, as it will cover medical expenses and lost wages in the event of an on-the-job injury.

Another vital financial aspect is obtaining a surety bond, which protects your clients against theft. It also serves as a guarantee of your business’s performance and ensures that clients are protected in the event your company fails to meet contractual obligations. A surety bond can also improve your business’s reputation and credibility among potential clients. I was able to find a $10,000, 1-year surety bond for $125/year. Prices in your area may differ.

If you’re interested in more detail on insurance for cleaning companies, we’ve put together a full article on the different types of insurance you may want to consider.

Equipment and Supplies

Tool up!

Essential Tools and Equipment

When starting a cleaning business in Florida, it’s important to invest in essential tools and equipment. These will help ensure efficient and thorough cleaning for your clients. Some of the must-have tools for your cleaning business include:

- Vacuum cleaners: Choose a reliable vacuum cleaner with good suction power and various attachments for cleaning different surfaces.

- Mop and bucket: Invest in a good quality mop with a wringer bucket for easy and effective floor cleaning.

- Brooms and dustpans: Both soft and hard bristle brooms are required for sweeping different types of surfaces. Don’t forget to have dustpans and small hand brooms handy as well.

- Microfiber cloths: These absorbent and lint-free cloths are essential for dusting and cleaning various surfaces without scratching them.

- Cleaning brushes: Invest in a set of cleaning brushes for scrubbing tiles, grout, and other hard-to-reach areas.

- Extension poles: These are useful for reaching high ceiling fans and windows, especially in commercial properties.

Investing in Quality Supplies

In addition to tools and equipment, your cleaning business will need a variety of cleaning supplies to get the job done right. Investing in quality supplies can make a significant difference in the overall results and satisfaction of your clients. Here are some key cleaning supplies to consider:

- All-purpose cleaner: A versatile cleaner that can be used on various surfaces, from countertops to floors.

- Glass cleaner: For streak-free windows and mirrors, opt for a reliable glass cleaner.

- Disinfectants: These are crucial for sanitizing surfaces, especially in high-touch areas like door handles and light switches.

- Degreaser: A powerful degreaser is necessary for tackling tough grease stains in kitchens and other areas.

- Carpet and upholstery cleaner: Choose a specialized cleaner for carpets and upholstered furniture to remove stains and odors effectively.

- Floor cleaner: Depending on the types of floors your clients have, you may need specialized floor cleaners for hardwood, tile, or laminate surfaces.

By investing in the right tools, equipment, and supplies, your Florida cleaning business will be well-equipped to provide exceptional service to your clients. Maintaining a neatly organized inventory and periodically updating your stock will ensure that you always have the necessary resources to meet the cleaning needs of your clients.

Hiring and Training Employees

Finding the Right Candidates

When starting a cleaning business in Florida, it’s essential to find the right candidates to join your team. Look for employees who are reliable, trustworthy, and detail-oriented. You can advertise job openings on local job boards, social media platforms, or even through referrals. Conduct thorough interviews to assess each candidate’s skills and experience. Ensure they have the necessary background checks and references to work within your customer’s homes.

Training and Development

Once you have hired employees for your cleaning business, it’s imperative to invest in their training and development. Start with a comprehensive onboarding program that covers your company’s policies, procedures, and cleaning techniques. This will help your employees understand the quality standards you expect from them and how to execute their tasks efficiently.

Provide periodic training sessions to keep your staff updated on new cleaning products, equipment, and industry best practices. Encourage employees to ask questions and voice their concerns, fostering an open learning environment.

Besides technical training, ensure that your employees are aware of customer service principles and how to communicate professionally with clients. Customer satisfaction can play a significant role in your business’s success.

When it comes to employees, don’t forget the importance of workers’ compensation insurance. This type of insurance will protect you and your workforce in the event of an injury on the job. In Florida, most businesses with four or more employees, either full-time or part-time, are required to carry workers’ compensation insurance. By having this insurance, you can safeguard your business from potential financial burdens and ensure a safer working environment.

Remember to strike a balance between hiring and training employees to achieve optimum efficiency and effectiveness in your cleaning business in Florida. This will ultimately lead to satisfied customers and steady growth.

Starting a business is not an easy task – you’re brave for starting down the path. The one thing that unites successful entrepreneurs is that they don’t stop. So keep going! And best of luck.

***

Frequently Asked Questions

What licenses are required for a cleaning business in Florida?

Although there are no specific cleaning licenses required in Florida, you must register your business with the state and obtain any applicable local licenses or permits. Additionally, you may want to consider getting insured and bonded and apply for an Employer Identification Number (EIN) for tax purposes.

Can I be a sole proprietor and hire employees in Florida?

Yes, but you will need to apply for an EIN from the IRS.

What is the cost of starting a cleaning business in Florida?

The cost of starting a cleaning business in Florida depends on various factors, including the type of cleaning services offered and the location of the business. Costs usually include business registration, insurance, purchasing equipment and supplies, and marketing efforts. It is essential to create a detailed business plan to estimate these costs effectively.

How profitable is a cleaning business in the state?

Cleaning businesses can be quite profitable in Florida due to its growing population and high tourism rates. Success in this industry depends on factors such as the quality of services, effective marketing, and the ability to maintain a loyal client base. Revenues can vary based on the size and scale of the business.

Do I need an LLC for my Florida cleaning business?

Although it is not required to form an LLC for a Florida cleaning business, many entrepreneurs choose this structure for its liability protection and tax benefits. An LLC helps separate personal assets from the business’s liabilities, making it a popular choice for small business owners. Be sure to research different business structures to determine the best fit for your cleaning business.

How much can a cleaning business earn in Florida?

The earnings for a cleaning business depend on factors such as the number of clients, type of cleaning services offered, and the hourly rate charged. In Florida, house cleaners can make anywhere from $25 – $75 an hour cleaning houses. The potential for a profitable business is high, especially when targeting high-demand areas, maintaining quality services, and retaining a loyal customer base.

What are some popular cleaning business names in Florida?

Choosing a catchy and unique business name is crucial for attracting clients and establishing a brand identity. Popular cleaning business names in Florida often include their service area, include terms related to cleanliness, or incorporate descriptive words to convey the quality of their services. While brainstorming names, consider your target customers and the message you want to convey about your cleaning business.