What is an EIN?

From the SBA.gov website on EINs

An EIN is a unique nine-digit number that identifies your business for tax purposes. It’s similar to a Social Security number but is meant for business related items only.

As a business owner, you’ll need an EIN to open a business bank account, apply for business licenses and file your tax returns. It’s helpful to apply for one as soon as you start planning your business. This will ensure there are no delays in getting the appropriate licenses or financing that you may need to operate.

What does an EIN get you?

- Allows you to open a business bank account

- Meets the requirements for certain license applications

- Allows your business to hire employees

- Required to operate as a partnership or corporation

Where would you apply for an EIN?

So where would you apply for an EIN (also known as a Federal Tax Identification Number)? You would apply for an EIN from the Internal Revenue Service (IRS). The government requires an EIN in many cases, but will they require it for your house-cleaning business? This question is vital not only for legal compliance but also for the smooth operation and growth of your venture.

When do residential cleaning companies need an EIN?

Let’s look at a few clear use cases for when you’ll need to apply for an EIN for your house cleaning business. If you are planning to do the following, you’ll need to register for an EIN:

- Hire cleaning employees

- Operate your cleaning business as a corporation or a partnership

- Withhold taxes on income, other than wages, paid to a non-resident alien

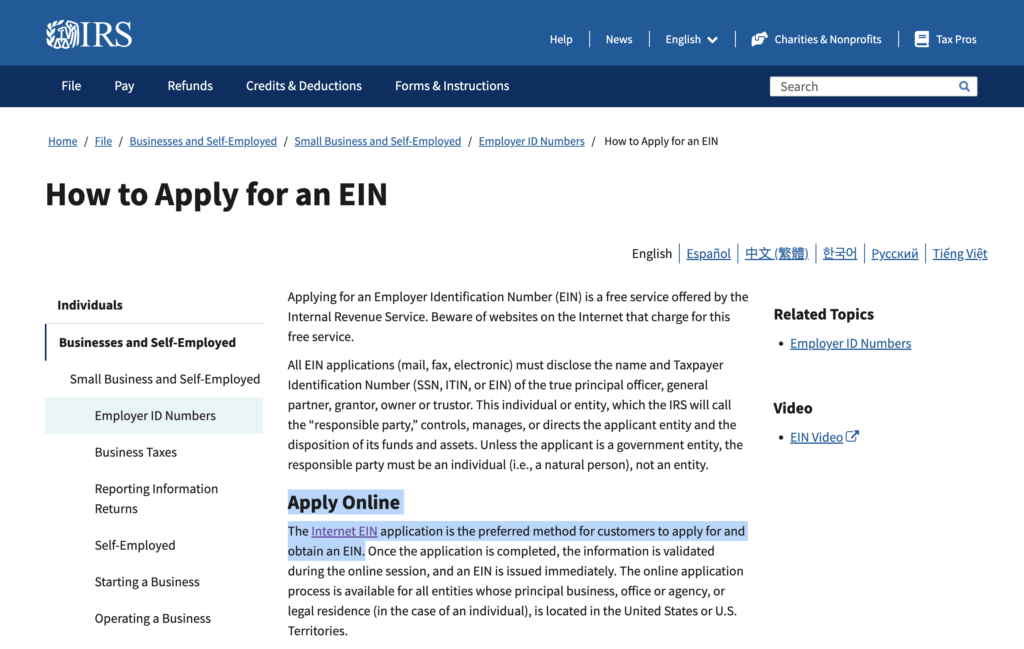

If you know that you’ll need an EIN for your cleaning company, you can go to the IRS directly and apply for one online. Additionally, other cases require you to register an EIN. The IRS has a handy guide to figure out of you need one based on your business structure.

Is an EIN required to operate my cleaning company as an LLC?

The answer to this question isn’t a clear-cut yes. However, from the IRS page on LLCs and EINs, it sounds like in most cases, the answer is yes – you’ll need an EIN.

How can I apply for an EIN?

You can apply for an EIN using many different methods.

- Online

- Fax

- Telephone (for international applicants)

Additionally, the online application instantly issues an EIN if you meet the required conditions.

The IRS keeps office hours for their online EIN application process. Therefore, it’s important to verify that you’re applying for your online EIN application only during office hours.

What are the eligibility requirements for an EIN?

From IRS.gov:

- If your principal business is located in the United States or U.S. Territories.

- The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN)

- You are limited to one EIN per responsible party per day.

- The “responsible party” is the person who ultimately owns or controls the entity or who exercises ultimate effective control over the entity. Unless the applicant is a government entity, the responsible party must be an individual (i.e., a natural person), not an entity.

Is there any alternative to an EIN?

Yes. Alternatively, you could use your Social Security Number (SSN). For example, if you’re a sole proprietor with no employees. In this case, you’ll (most likely) use your SSN to file taxes on your business income.

So what other licenses do I need to become a house cleaner?

We cover this topic in-depth in our article about getting licensed and insured as a new house cleaning company. Furthermore, if you want to start a cleaning business in Texas or Florida, we have in-depth articles about starting residential cleaning businesses in those states.

We also wrote a comprehensive guide on starting a successful house cleaning business. We cover everything you need to know to start and run a thriving cleaning service. If you have more questions about licensing, or want to learn more about running a cleaning business, this is the article for you.